When it comes to building intelligent technology, developers have to balance great coding with usability and empathy. In a digitally-driven world, back-end functionality has become table stakes as tools for customer-centricity has become the new battlegrounds for success. This is where UX design in fintech will separate the leaders from the laggards in the digital road ahead.

What exactly is UX?

Simply put, user experience (UX) design aims to improve customer attraction and retention by improving the ease-of-use, usefulness and satisfaction levels when interacting with a product or service online. It’s a user-centric approach that enhances the tangible experience someone has, ensuring that they derive as much value as possible. The use of workflows, prompts, design elements and animations are some of the creative ways to heighten the user experience.

A UX design process helps to uncover what elements can be used to stimulate a delightful and emotional online experience. A great example is the celebration creatures in the project management tool, Asana. Not only does it make completing tasks fun and rewarding, but it’s incredibly unique and a great acquisition tool.

These experiences can be more difficult to engineer and require a deep understanding of who the user is, what their needs are and what your company can do to satisfy these needs better than competitors.

The different levels of UX

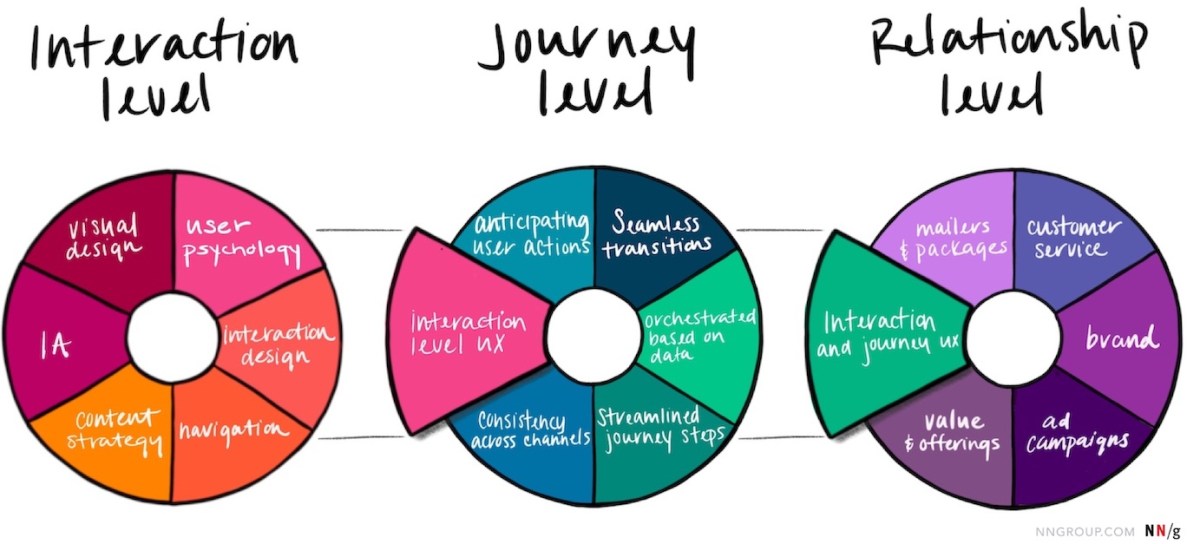

It’s important to remember that there are multiple levels of experience that a user can have with your organisation. The Nielsen Norman Group identifies 3 main levels: the single-interaction level, the journey level and the relationship level.

- Single-interaction level: The experience a user has on one device when completing a specific task. For example, an investor downloading the latest market performance report from a customer portal. These individual experiences form a small part of the relationship a customer has with a company. From a UX design standpoint, channel-specific principles and patterns are adhered to, creating a seamless individual experience.

- Journey level: The journey experience is where a user goes through a process to complete a goal over time. For example, onboarding a new client. In most cases, this process involves the use of multiple channels such as email, phone and website. From a UX design perspective, the goal is to try and make the journey level experience as effortless and coherent as possible to avoid friction. This requires the integration and coordination of the single-interaction level experiences.

- Relationship level: Also known as the customer experience, this focuses on the total experience that a customer has with an organisation. It’s the culmination of single-interaction and journey-level experiences, and weaving together broader experience elements such as ad campaigns, branding activities and customer service processes. For example, the integrated journey of a user researching and investing into a Kiwisaver fund, the subsequent calls with advisors and the additional transactions or switches during their investment journey. Focusing on the smaller, single-interaction levels is a good starting point. However, it must be implemented in a way that complements and supports the entire relationship-level experience.

[The three levels of user experience. The Interaction level influences the journey level, which both then influence the relationship level. Image credit: nngroup.com]

UX design in fintech

It’s reported that fewer than 50% of younger HNWIs are satisfied with the current online and mobile platforms available. This indicates that wealth and asset managers need to drastically improve their offerings to provide the personalisation and attention this segment demands.

It’s not just the younger generation who are looking for online solutions. Betterment indicated that over a third of their customer base is over the age of 50. With an estimated $68trillion set to be transferred between current HNWIs to Gen X and millennials over the next 25 years, wealth and asset managers must adopt a more customer-centric model to service different segments during this transition. This poses an interesting challenge: is it possible to provide a tailored digital experience for customers across different segments?

The answer is yes. This is where UX design in fintech applications are highly effective. The needs of different user segments can be addressed by creating digital experiences that delight and excite throughout each stage of their journey. It’s about using technology as a means to connect with each user on a deeply human level.

A working example: a UX design case study

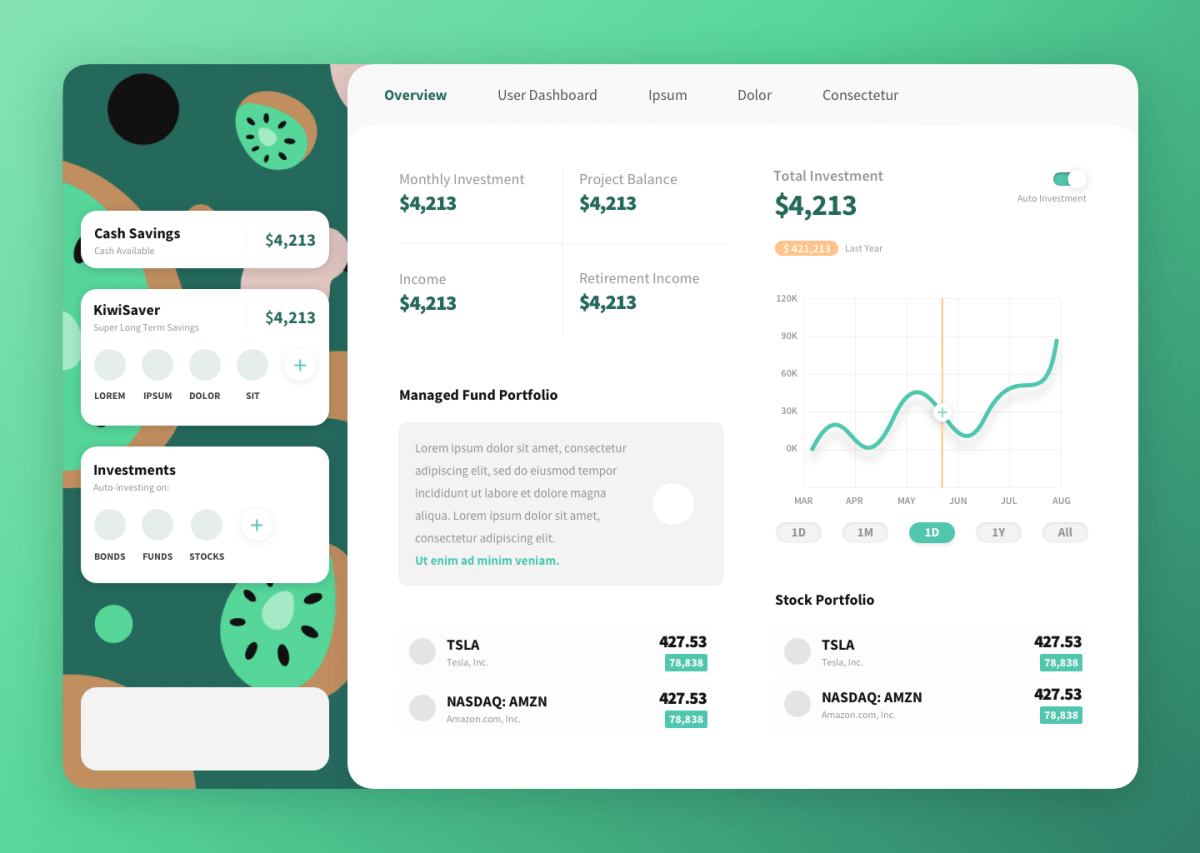

Invsta recently did some design mockups for a UX-driven customer portal for a local wealth manager. The brief was simple: create an engaging customer portal for the millennial market.

[Example of Invsta’s white label customer portal for a New Zealand wealth advisor, designed specifically for the millennial market.]

The millennial segment represents first-time investors, therefore we needed to make sure that relevant information was available to the user without overwhelming them. The use of drop-down arrows, ‘read more’ buttons and clickable sections provide further reading without being too text-heavy. The grey block uses customer data to generate relevant and timely information that is specific to each user and their portfolio.

There is a strong emphasis on graphics and visual charts to relay information. By making these elements clickable, users can engage with the information in real-time, which helps to improve the financial literacy of this segment.

The use of bright and bold real-time numerical figures help to make investments more tangible and contextual to a younger market. Investment tracking tools enable users to track their investment goals in real-time, helping to minimise switching.

The colour green was chosen to instil a sense of balance. On a subconscious and primitive level, the colour green symbolises life and a presence of water, promoting growth and abundance. Creating a stable and reassuring first impression is paramount for first-time investors.

Lastly, the client wanted to instil a sense of excitement and delight around investing. The kiwifruit background creates a fun and youthful look while paying homage to the wealth manager’s local origins.

The end result: a highly interactive and modern platform that gives users the freedom to access information as and when they want.

Humanising the digital experience

The key to creating a holistic, humanised digital experience lies in combining an effective segmentation strategy with a UX design process.

To quote Hidde Burgmans, Service Designer & Product manager at Koos service design: “People have a hard time identifying with code, a device or lifeless designs. The user experience will lift off when a different part of the brain is addressed. This happens when your user realises she or he is not just looking at pixels, but that there’s actually a bunch of people behind this service trying to tell them a story. Making your product more human and deepening the brand experience will make your service more enjoyable to use.”

Not sure where to get started? Feel free to reach out to me directly, and let’s identify how UX design in fintech could help your business achieve sustainable growth. My email is abhy@invsta.com