Biometrics: The future of safe, remote access for investors

Since the arrival of fingerprint scanners on mobile phones in the mid-2000's, the use of biometric technology has faced rapid deployment across the financial services landscape. As the demand for online investment in the wealth management sector increases, companies are turning to biometric technology to protect their clients against payment and identity fraud.

What is biometrics?

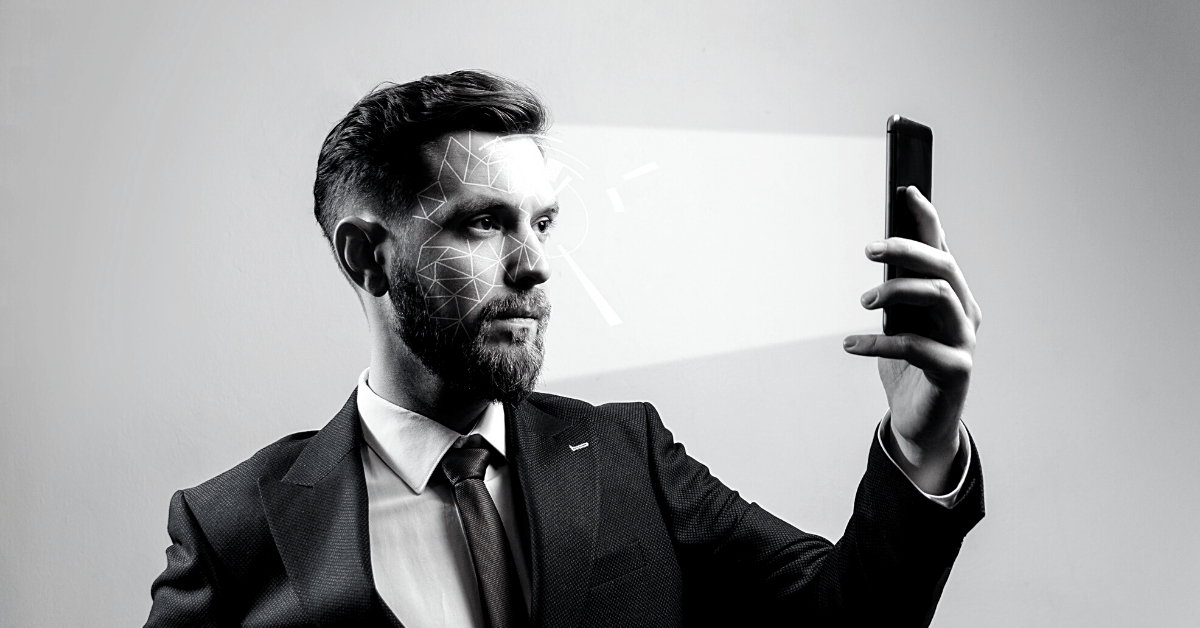

Biometrics involves the measurement and statistical analysis of a person’s physical characteristics, such as their face, fingerprints, eyes or voice. This technology is used to authenticate identity to help improve security and control the accessibility of sensitive information. Firstly, the process involves a device that scans the biometric factor being validated. This is followed up by intelligent software that converts that scanned area into a standardised digital format which then gets compared against stored data, which could be located on the actual device or could be linked up to a regulatory body’s stored data.

How are wealth management companies using biometrics?

The financial services industry has always been prone to cyberattacks and security breaches. According to a recent report from Fsecure, there was a 300% increase in the number of cyber attacks on internet of things (IoT) devices in 2019. Security breaches can have a disastrous effect on a company’s reputation, with serious financial implications for customers who have been exploited. Biometrics is proving to be a brilliant way to strengthen security without having to remember yet another set of complicated passwords. It’s an engaging form of security that helps to improve the user experience and build trust with your customer base. Both retail-focused and wholesale-focused financial providers stand to benefit from this added level of security.

For wholesale-focused providers wanting to digitise their onboarding and investment processes, biometric authentication will not only instil confidence in potential investors but will also drive a better customer experience. Cumbersome manual processes are a barrier to investment, which has a big impact on the bottom line. Biometric technology has the potential to open up new channels to market by speeding up the digital onboarding and investment process while satisfying ever-changing compliance regulations. Anti-money laundering (AML) and know-your-customer (KYC) processes can now be done remotely through mobile and computer devices. For example, facial recognition can be used for remote validation of identity by comparing facial features in real-time in both video and image format to measure certainty and satisfy proof of life.

The EU’s General Data Privacy Regulation (GDPR) and open banking mandates of the second Payment Services Directive (PSD2) have pushed financial service providers to iidentify streamlined ways to deliver multi-factor secure customer authentication (SCA) solutions to their customers. Biometrics, in conjunction with standard password-security systems, serves as a powerful two-factor authentication security process to thwart fraud and security breaches.

Customer experience is everything

Aside from the obvious efficiency and safety benefits of biometrics, this technology offers a great solution to bolster security without having to compromise the user experience. With the average person having up to 90 accounts, remembering passwords is a nightmare for consumers. With up to a third of online purchases abandoned at checkout, companies that aren’t actively looking for ways to streamline key customer conversion processes stand to lose a substantial amount of money. Combined with ever-changing data regulation and compliance measures, financial service providers need to start thinking ahead and put measurements in place now to gain a competitive edge. Biometrics is an effective future-proofing tool that strikes the balance between security and convenience.