Over the next 25 years, the financial services industry is set to witness the biggest generational transfer of wealth ever seen. It’s estimated that over $68trillion will be passed down from current high-net-worth individuals (HNWIs) to their Gen X and millennial children over the next 25 years. It’s an incredible opportunity for financial service providers (FSPs) to scale their businesses and address the financial needs of a much wider audience – this is where artificial intelligence, powered by machine learning, will play a critical role in determining the leaders and the laggards. The next generation of investors can loosely be categorised into two groups; the emerging HNWIs, who are typically younger and more digitally native than their predecessors, and the emerging mass affluent group, who present a smaller investment balance but on a much larger scale.

This is how we predict AI will help firms to align themselves to the shifting customer dynamics.

Delivering a seamless client experience

The powerful streamlining capabilities of AI will help to provide a more efficient and speedy investment experience. For a generation that favours digital touchpoints over traditional interactions, AI can help to optimise these processes to ensure a richer and more engaging experience.

We’re already starting to see the benefits of AI being used in the digital account setup process. Lengthy, paper-based KYC and AML forms are now being replaced by slick and intuitive digital workflows that are instantly verified against relevant databases, reducing the administration nightmare for investors and client-facing teams alike. In a world where instant gratification is the norm, speeding up the onboarding process has the potential to improve customer acquisition rates while driving down acquisition costs.

Embedding AI technology and machine learning into financial calculators and investment tracking tools can help to unearth a treasure trove of data. Depending on how your investor portal is set up, algorithms can track and process how your customers are engaging with the various digital tools and information, providing insights into their interests, changes in financial situations and investment risk appetite.

Delivering curated advice and creating customised portfolios

The 2019 World Wealth Report indicated that only 33% of younger HNWIs were satisfied with the current level of personalisation and tailored offerings. FSPs are coming up short and need to quickly restructure their business models and technology structures to centre around this need for individualisation to stay relevant to the emerging market.

Good quality data, gathered from multiple sources both externally and internally, is one of the key ingredients to maximise the potential of AI and machine learning. Without it, the system cannot learn from past patterns of behaviour and create predictions and future scenarios. Companies need to figure out what information they need, as this will determine the data sources. While tapping into data from external sources can pose a security and privacy risk if not managed properly, the level of customer insights that can be gathered will help FSPs to really service their customer base in a more personalised way, giving them the competitive edge over other providers.

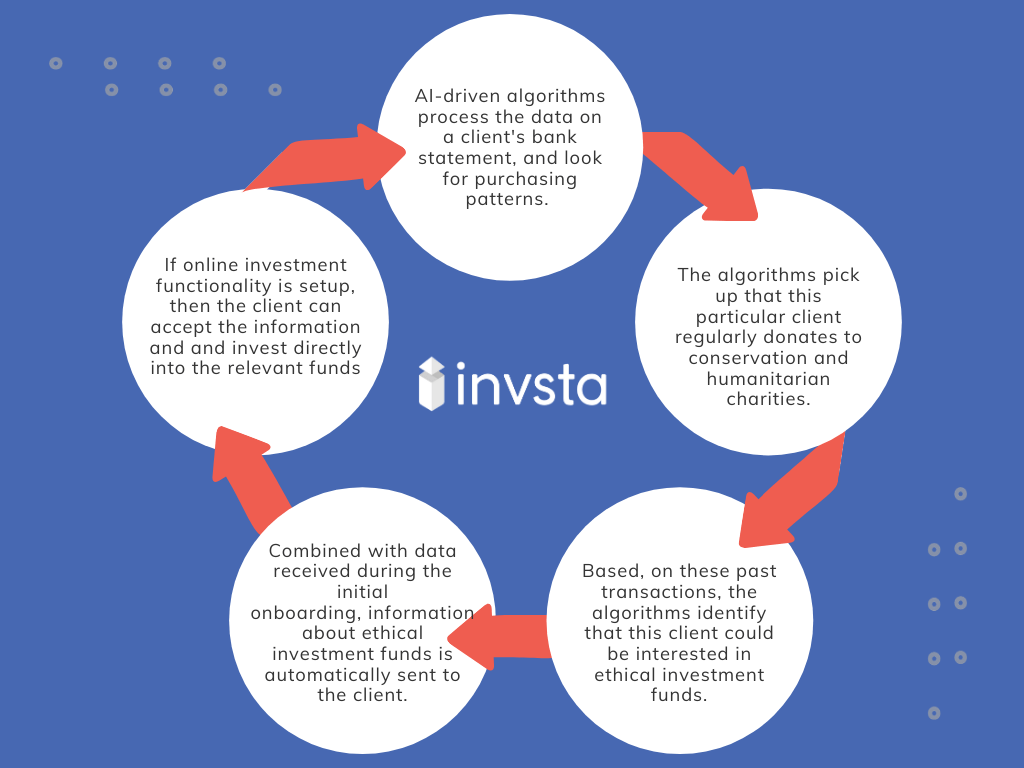

For example, if you could tap into your customers’ spending data, their purchasing habits would provide some insight into what their priorities are. The powerful AI-driven algorithms process the data from a client’s bank statement and can start building out a tailored portfolio or provide automated advice around this. Have a look at the example below:

For the above scenario to work, companies will need to look at their systems architecture, and adopt an application programming interface (API) modular framework to be able to transfer and process multiple sources of data at lightning speed. Unlike traditional legacy systems, APIs allow data to flow between different applications, allowing companies to harness this context-rich customer data. Information is no longer analysed in silos but rather combined to provide detail-driven insights which can be accessed in real-time. Companies can apply these insights and create innovative portfolios and funds that satisfy client, market and regulatory needs.

Streamlining back-end and front-office functionality

The scope of application for AI and machine learning holds infinite possibility and opportunities. From streamlining front-office processes, such as digital onboarding and investor portals, through to automating back-end tasks such as storing compliance documentation and generating reports, we expect to see AI fully integrated into business-as-usual processes.

The use of AI and machine learning in robo-advice is set to expand as trust and confidence in this technology grows. The emerging mass affluent, who are typically further down the wealth scale but present a much larger market size, will increasingly look for financial and investment advice to navigate market volatility, particularly after experiencing the market downturn effects of Covid-19. Robo-advice, also known as digital advice, is crucial to service this growing segment in a cost-effective and personalised way, as the automation of the advice process presents multiple resource-saving benefits. A recent report by the Financial Services Council of New Zealand indicated that over 60% of non-advised respondents “didn’t think that they had enough assets and wealth to need professional financial advice, and think that it is unaffordable”. Digital advice presents the strongest case to address these perceptions, as it allows FSPs to effectively service those with smaller amounts of money to invest.

As tough market conditions, increased risk and changing regulations continue to disrupt the financial services landscape, automating key compliance processes will play an integral role in customer satisfaction. A recent report by Thomson Reuters Regulatory Intelligence suggests that the top 3 solutions that FS providers are introducing to satisfy compliance needs are KYC and onboarding, AML and sanctions compliance and market surveillance activities, which monitor trade and transactions. Not only will it help to simplify and standardise the compliance process internally for employees, but digitising these processes will drive an efficient, seamless customer experience that isn’t tainted by complex forms and back-and-forth emails. It also helps to drive a more flexible business model, which enables firms to adapt to changes in regulations quickly and reduces the downtime for clients.

So, what’s the best way for FSPs to implement an AI strategy?

The next generation of investors is far more demanding and influential than their baby-boomer predecessors, and FSPs need to start investing in the powerful benefits of AI and machine learning to create great digital experiences that enable better financial outcomes for clients. Here are my top 2 tips when implementing an AI strategy:

⦁ Partner with a third-party provider

Over the years, fintechs have mastered the art of servicing customers how and when they want. They have built their entire business model around their customers, so it makes sense for FSPs to leverage the efficiencies, client-centric positioning and design-driven approach that has made fintechs so disruptive. It will also allow FSPs to quickly implement an effective digital solution without having to go through the costly and time-consuming process of building their own system.

⦁ Set realistic expectations

Set SMART goals when it comes to your AI strategy, rather than implementing it for the sake of it. It’s also important to measure the return on investment (ROI) of your AI technology, as this will provide insights into how effective it is as a driver of growth, and where else it can be applied across the business to leverage even more growth potential.

From speeding up processes to offering curated advice to the masses, the impact of AI on FSPs will lead to a complete reinvention and repositioning of companies in the future. However, businesses cannot afford to become complacent and must look to actively implement strategies that incorporate AI-driven technology and solutions, or risk being left behind.

Sources:

⦁ Osterland, A 2019, What the coming $68 trillion Great Wealth Transfer means for financial advisors, CNBC, USA, viewed 15 June 2020,

CNBC: what-the-68-trillion-great-wealth-transfer-means-for-advisors

⦁ Sullivan, W, Thakral, C 2019, World Wealth Report 2019, CapGemini, France, viewed 12 June 2020,

Capgemini: World-Wealth-Report-WWR-2019

⦁ Money &You (2020), The Financial Services Council of New Zealand, New Zealand, viewed 13 September 2020,

https://blog.fsc.org.nz/research-2020-literacy-insight-advice

⦁ Hammond, S, Kovas, A 2019, Thomson Reuters Regulatory Intelligence, Canada, Viewed 24-30 June 2020,

ThomsonReutersFinancialRiskD_Fintech__Regtech_and_the_Role_of_Compliance_2020