Digital transformation is not easy. With the rapid pace of technological change, building an effective and achievable digital roadmap can be a daunting task. Market shifts and emerging technologies combine to create a challenging environment for project managers to ensure that digital projects are completed on time. To ensure project success, project managers need to adopt an approach that focuses on phasing in the various digital elements, rather than trying to implement the entire project as a whole from the get-go.

Roadmapping versus release plans

A roadmap is an important tool to display initiatives to help support digital strategies. They are outcome-focused and aligned to the overarching strategy. A roadmap is directly tied to achieving a goal for the business and is typically drawn up by members of the C-Suite. Think of it as the guiding vision of your digital strategy – the desired end state which is aligned to the company’s overarching organisational vision and mission statement.

A release plan is the productivity arm of a roadmap. It differs from a roadmap in that it details a timeline with corresponding activities and tasks to achieve by certain due dates. Release plans are essential in steering and assigning responsibility to project teams to mobilise the roadmap. This is usually drawn up by the project manager, who liaises directly to the person responsible for drawing up the roadmap. The most common release plan comes in the form of a Gantt chart.

Common roadmap problems

According to McKinsey, just over one-third of companies are stuck in the piloting phase of their digital transformation projects. Some of the key stumbling blocks when rolling out new technology is a lack of funds, moving too slowly, overextension and unnecessary changes. Wealth and asset management companies need to be realistic about the resources and capabilities they have internally.

One of the most common problems that I’ve come across over the years as a software architect is that companies tend to create lengthy and complex digital roadmaps. These roadmaps often make the digital transformation process more complicated than it needs to be. Unrealistic roadmaps create a vicious circle whereby internal stakeholders lose confidence in the project team, and customers lose faith in the brand’s ability to keep up with the pace of change.

While it’s important to have a high-level strategy, roadmap creators need to factor in small, achievable goals throughout the digital journey to keep stakeholders invested in the transformation process. With the operating environment as dynamic and fast-paced as it is, these goals need to be revisited on a regular basis so that you can pivot your strategy and business for quick wins.

On the other side of the spectrum, quick-fix solutions often lead to problems later on down the line. Your digital architecture becomes a patchwork of mismatched legacy software and new-age applications, which becomes a nightmare for your IT team to manage. This is where a digital roadmap is vital as it provides direction to keep project teams on track and aligned to the overall business goals without getting distracted by band-aid solutions.

Framework for digital transformation success

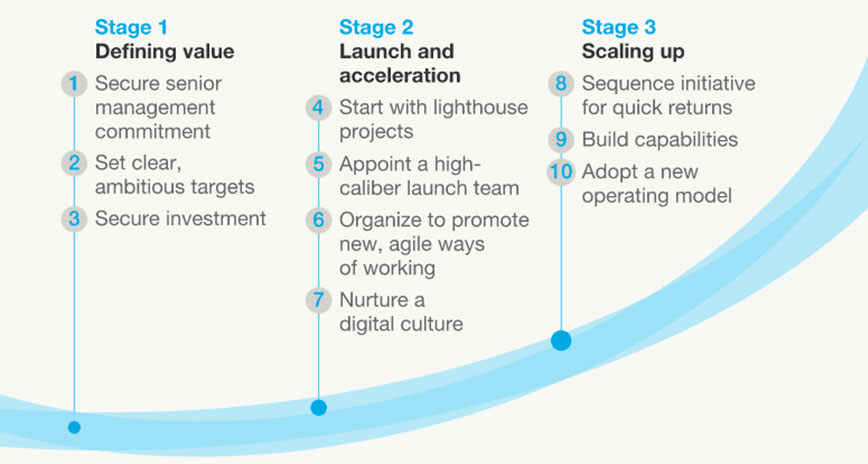

McKinsey & Company have come up with a simple framework on which to hang your digital roadmap onto. They have identified 10 guiding principles based on their observations from leading financial service providers who have successfully undergone digital transformation journeys.

[Image source: https://www.mckinsey.com/industries/financial-services/our-insights/a-roadmap-for-a-digital-transformation]

Stage 1 provides some great principles when designing your roadmap and would be the responsibility of the C-Suite team. They have the organisational overview to set clear targets aligned to the overall vision, and provide the necessary investment to ensure project success. By going through these steps, top tier executives are defining the importance or value of the project to the business. It’s important to note that in order to help support project effort, digital transformation goals have to become core to the business’s agenda.

Stage 2 is launching and accelerating the roadmap as outlined by the executive team. This stage would be the responsibility of the project manager, who is tasked to create a release plan to achieve the digital roadmap. The first task highlighted in stage 2 deal talks about starting with lighthouse projects – what we like to call small, easy wins.

A phased approach of starting small and then building in complexity is a great way to garner early support and deliver tangible results to stakeholders. They have the potential for reaping early rewards with manageable risk. These projects are necessary to establish your feedback loop with stakeholders. The project team can mobilise changes more quickly and precisely with smaller projects. Once perfected, this feedback process can be carried over to bigger projects.

Lighthouse projects to get the roadmap underway

At Invsta, we’ve noticed that companies who deliver the most successful digital projects are those that focus on quick wins by getting the smaller projects done first. Not only does this enable faster results, but it helps to build up momentum to tackle more complex projects with confidence. Remember that one of the reasons you started your digital transformation journey was to keep or grow your market share. Digitally-enabled businesses move quickly, and to compete in this new market you simply cannot afford to stall on your release plans and project timelines.

In the image above, we’ve highlighted key lighthouse projects that every financial service provider can stand to benefit from, as these functionalities are considered the basic building blocks of a modern digital investment experience.

Digitalising the onboarding process is a quick and easy first task to put onto your digital release plan. As a crucial first step in the customer acquisition process, it makes sense to enhance the customer experience during this important interaction. Automating this process is a great way to get buy-in from all stakeholders, as digital onboarding has numerous benefits across the company – both for employees and customers.

Our customisable digital onboarding solution is designed to get financial service providers online quickly, so that they can get their products out to new markets and compete with other direct-to-retail investment offerings. From quick and simple individual account opening, through to complex, multi-level ownership structures and wholesale investor documentation, our solution can be adapted to incorporate company-specific workflows.

Secondly, eKYC and eAML further enhance the onboarding experience by streamlining and automating compliance processes for new clients. Information can be verified across global databases in a matter of seconds, resulting in a speedier sign-up process for clients. It’s a simple, easy to implement technology that can boost your acquisition numbers and reduce the administration burden for client teams.

Thirdly, an engaging and intelligent coss-device customer portal is an important second project. Giving clients the ability to edit static profile information directly in the portal, such as contact details, should be a standard function. Interactive dashboards with visual tracking tools and pop-up windows helps to provide contextual information to investors. Modern investors are seeking transparency and more control when it comes to their investments, so this is an easy way to help improve the investor experience.

Fourthly, administration and compliance portals is an easy project to improve access and visibility for internal stakeholders. There are many ways these portals can be setup, so it’s important to identify what kind of functionality you want these portals to have. At Invsta, we’ve noticed that companies are increasingly wanting to provide a tailored experience for different employees accessing their portals. For example, role-based access displays only the most relevant information to each employee, helping them to deliver an exceptional customer experience.

Lastly, user analytics will provide insight into what is important to your customers by extracting contextual information based on how they interact with the tools, portals and information available to them. This is particularly useful for sales, marketing and executive teams who need data to understand customer segments and develop strategies to push the business forward. Modern investors are increasingly looking for more personalised digital experiences, and user analytics will help to unlock what companies need to give to investors at each stage of their journey.

Quick, easy wins to drive success

Since the pandemic, we’ve seen a dramatic increase in the number of financial service companies that are ramping up their digital presence. A strategic fintech digital roadmap is crucial to ensure that your financial service business stays relevant in the face of growing competition.

With new digital tools and innovative technology being announced almost weekly, it can be overwhelming for companies to build a roadmap. Because of this, roadmaps must be fluid and flexible to accommodate these new technologies and functionalities.

Delivering tangible results to stakeholders helps to improve the corporate culture towards change. These easy, quick wins are important in driving positive employee and customer responses to digital innovation (which can be met with scepticism and apprehension if not managed properly).