As financial service providers embark on their digital transformation journeys, the age-old question comes up: is it better to build, buy or rent software and what are the various fintech approaches for wealth providers? It’s important to identify which option is best based on the constraints and needs of your business.

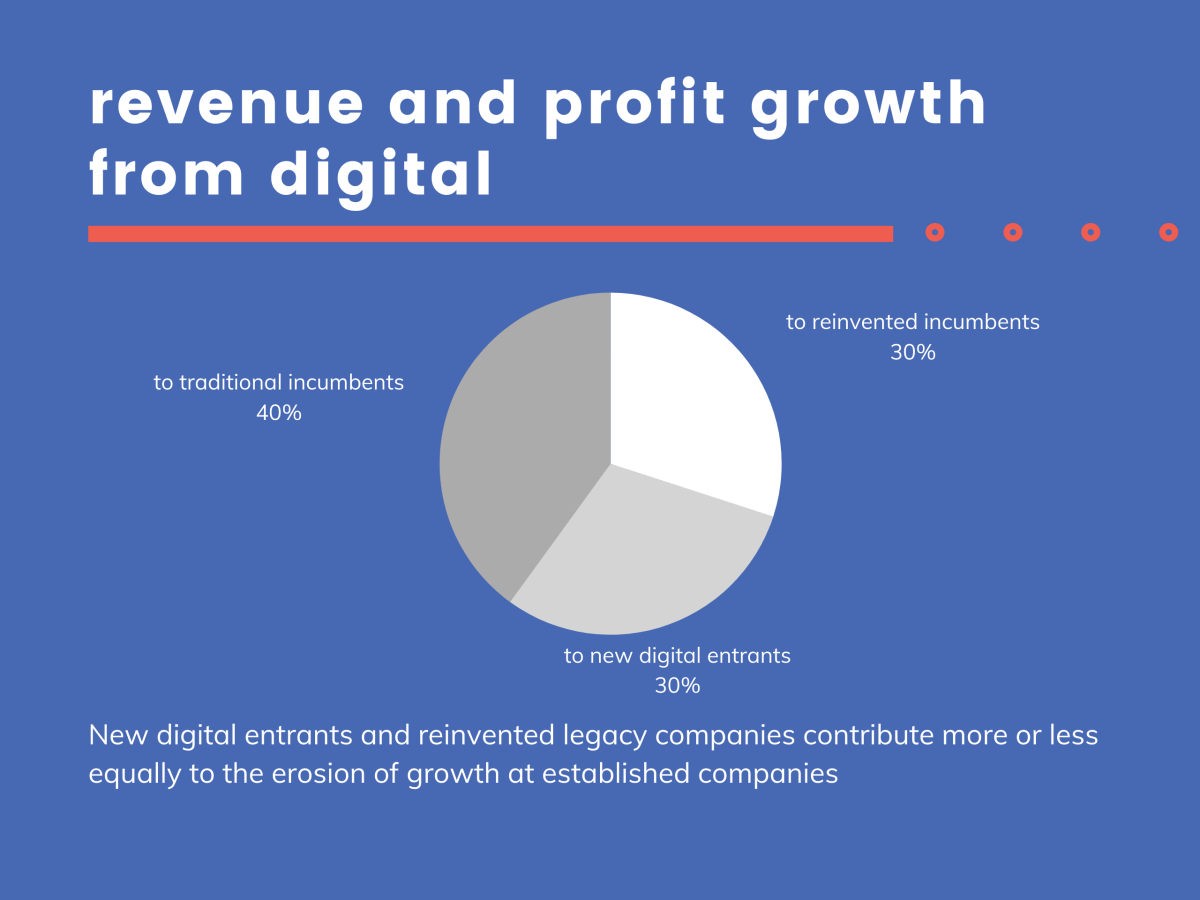

Fuelled by consumer and market shifts as a result of the Covid-19 landscape, competition is heating up in the financial service sector. Data from McKinsey & Company indicates that new fintech and nontraditional players, as well as reinvented incumbents, are contributing to the declining growth of established financial service providers. Gartner data reveals that up to 80% of incumbent financial service providers will face irrelevancy by 2030. In light of this threat, incumbents are having to rapidly adjust and adapt their business models to thwart-off competition and meet the digital demands of modern investors.

New digital entrants and reinvented legacy companies contribute more or less equally to the erosion of growth at established companies. Image source: Five Fifty – The Legacy Threat, McKinsey & Company, 2020

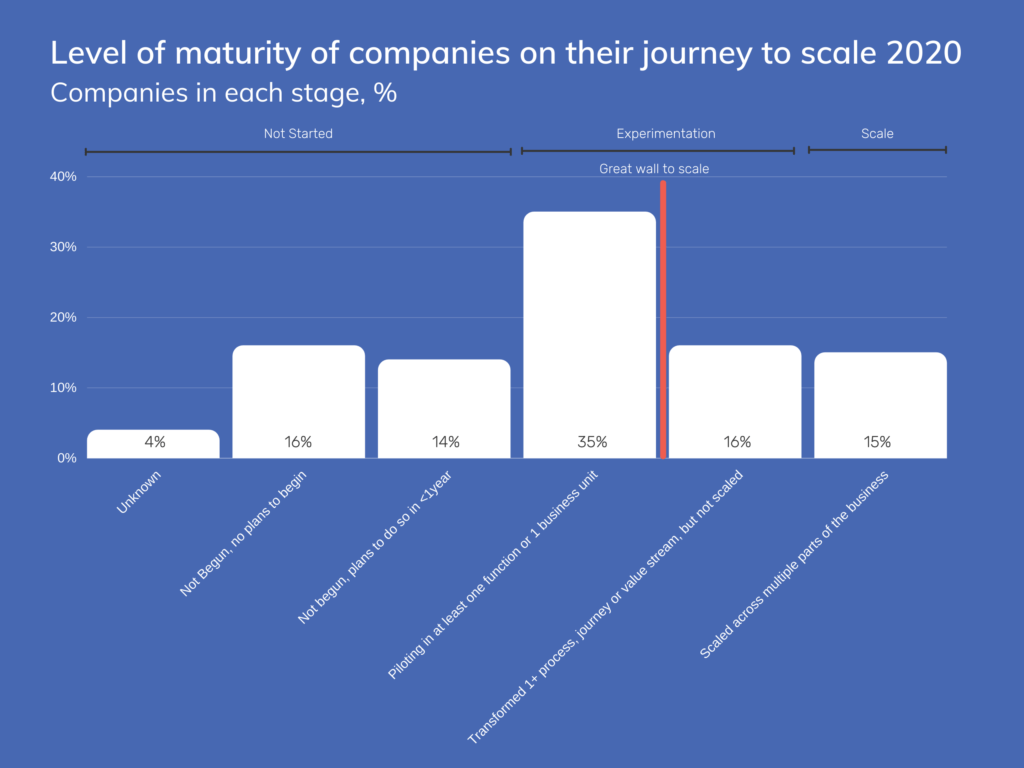

According to Kalra et al, just over one-third of companies are stuck in the piloting phase of digital transformation projects. Lack of funds, project distraction, overextension and tunnel vision are some of the key stumbling blocks when it comes to rolling out new technology.

To avoid this, wealth and asset management companies need to be realistic about how best to maximise and utilise the resources and capabilities they have within their wealth and asset management company. Let’s take a look at the three fintech approaches for wealth providers: building, buying or renting software.

Percentage of companies and their level of maturity on their journey to scale. Image source: Breaching the Great Wall to Scale, McKinsey & Company, 2020

Build

Generally speaking, if the technology that you need forms part of your core value proposition or if your business needs are very specific, then it may well make sense to build it internally. If the software doesn’t form part of your core focus or if your problem can be addressed by solutions currently in the market, then it’s likely that building it yourself is not the right option.

It’s important to consider the total cost of ownership (TCO) when undergoing a customised technology build internally, as this will help to determine whether it makes financial sense, in the long run, to go down this route. TCO goes beyond the direct project costs and includes metrics such as opportunity cost, technical debt, quality control and ongoing negative economies of scale.

Opportunity Cost:

There’s no point in trying to reinvent the wheel. Keeping up with the pace of innovation requires significant internal resources, which potentially could be better utilised elsewhere to help support your core business.

Identify what the opportunity cost is of building it yourself. Will you be taking employees away from meaningful tasks, and will it be to the detriment of other projects? What could these additional resources be spent on elsewhere and how does that compare to the project in terms of creating value for the business?

Quality Control:

Building intelligent software of great quality costs time and money – often more than expected. According to a 2017 report from the Project Management Institute, 49% of IT projects were late, 43% exceeded budgets, 31% didn’t reach their goals and 14% failed completely.

It’s important to consider whether you can see the project through to completion, even if it goes beyond the scope of the initial project plan. If you do not have enough resources, then chances are the software won’t be as functional as originally planned, or even functional at all, which could ultimately be a complete waste of time and money.

It’s also important to consider whether your internal resources are capable enough to deliver the quality product you need. Perhaps your focus and internal efforts are not centred around solving the exact problem you’re looking to solve with the software build. In this case, choosing to partner with an external supplier could yield a better quality product, as they are more invested and technically capable of solving problems.

Technical Debt:

Technical debt is a term in software development that reflects a company’s choice to prioritise speedy delivery over perfect code, with the understanding that they’ll need to fix the flawed software in the future. In a case where there are time or budget pressures, technical debt can be taken on intentionally as a quick-fix solution. It can also come as a result of poor planning and architecture.

When a technical debt is not paid back, it can cause major time and money losses, as well as irreversible problems to the build quality. It can reach a point where development teams can no longer add new functionality, resulting in a complete software overhaul.

Negative Economies of Scale:

Sourcing tools and unexpected expenses, such as server fees and monthly database charges, can be a costly exercise when choosing to build internally.

Third-party companies that can spread these costs across their clients have a huge advantage when it comes to charging less for a product than if you were to build it yourself. Essentially, you need to consider whether the product will contribute enough to the bottom line to justify the cost of operations. If this puts your business at a disadvantage, then perhaps buying or renting may be a better option.

Pros & Cons of Building:

Pros:

- Software can be customised to your unique workflows.

- More control gives you the functionality you need in the ways you need it most.

Cons:

- High upfront costs, as well as higher ongoing maintenance and operational costs, such as internal IT teams and hosting.

- Timely to build, placing a huge amount of strain on all resources.

- Difficult to manage internal upgrades to keep up with the pace of digital innovation.

Resources Needed to Build:

The build option is by far the most resource-heavy option. Having access to these resources internally may ease the financial burden and time constraints, however, it’s important to consider the opportunity cost of the build. Here is a generic list of the types of resources you will need to build and manage a fintech solution from scratch:

Capital Expenses

- Project manager*

- UX and backend developers*

- Server

- Computer hardware

- Software tester*

- Software architect*

- Third-party licences (security etc)

- Budget to support completion of the build

- Networking costs

- Business Analysts and Subject Matter Experts

* Items could also be an operating expenditure due to upgrades, and system modifications that require these resources continually.

Operating Expenses

- Cloud hosting fees

- Staff and user training

- Third-party integration costs

- IT team, eg Security Professionals

- System upgrades, troubleshooting and customisation

- Server/data centre power and cooling costs (if hosted on-premise)

- Infrastructure/Cloud Engineers

- Application Management and Performance Platform

An important question to ask yourself is this: at the heart of it all, is your business a software company or a financial services provider? If your business is the latter, then perhaps a buy or rent option is better as it allows you to focus on your core business objectives.

Buy

Buying refers to the purchase of an off-the-shelf, pre-built solution. The purchasing of software licences and open-source platforms is a much quicker option than building, but you’re still required to manage maintenance and upgrades internally.

Essentially, you haven’t gone through the hassle of starting from scratch, but you do however own the problem (same as if you were to build a solution). If the software vendor adds new features or requires security upgrades, your IT department will need to manage this internally.

If the pre-built technology forms part of your core value proposition and you have the internal capabilities and resources to continually invest and customise the solution as your business evolves, then buying could be right for you. What it boils down to is the level of customisation you need to address your business problem most effectively and efficiently and whether or not there is a suitable solution available to purchase.

Gauge your need for customisation

It’s important to identify how much customisation you need when it comes to technology solutions. The more customisation you want, the more it’s going to cost you. Many modern fintech providers offer modular off-the-shelf solutions. Driven by APIs, these systems provide much more flexibility and scope for customisation than legacy programs and operating systems.

Here are a few easy steps to take to determine how much you are willing to pay for customisation:

- Firstly, price up an off-the-shelf solution that best suits your needs. This will give you a rough cost for the functionality you need.

- Secondly, estimate what it will cost for you to build a customised solution that matches your needs perfectly. It’s safe to assume that building will cost more, and in our experience, it can cost as many as 10 times more than buying a pre-built solution.

- Thirdly, gauge how much you value the customisation. Can you adapt your workflows to suit the pre-built solution? Is your problem common in the industry and is it being adequately solved with a pre-built solution? Compare the TCO and impact to the bottom line when reviewing the need for customised solutions.

Pros and Cons of Buying:

Pros:

- Lower upfront costs – typically cheaper to buy and implement.

- Faster implementation than building.

Cons:

- Can have limited functionality and is more rigid in its capabilities.

- Not much wiggle room for customisation.

- Could be incompatible with other systems and data streams that are paramount to your systems architecture.

- Upgrades and security patches need to be managed internally, which could distract you from your core mission.

Resources Needed to Buy:

The buying option is less of a resource constraint than building, with the majority of resource usage stemming from maintaining the solution once you’ve bought it. Here is a generic list of the resources you will need to implement and maintain a pre-build solution:

Capital Expenses

- Initial software purchase

- Server

- Third-party licences (security etc)

- Computer hardware

- Networking costs

- Internal Project Coordinator/Manager

- Business Analysts and Subject Matter Experts

Operating Expenses

- IT team, eg Security Professionals

- System upgrades and troubleshooting

- Cloud hosting fees

- Third-party integration costs (security etc.)

- Staff and user training

- Server/data centre power and cooling costs (if hosted on-premise)

Issues, upgrades and troubleshooting will inevitably pop up. Depending on the type of agreement you have with the vendor, you’ll more than likely have to factor these costs into your operating expenses.

As competition heats up in the software space, providers have had to become more flexible and accomodating to their customers’ needs to stay competitive The sector has moved beyond the early days of rigid Microsoft-type software, giving customers more flexibility and power when it comes to negotiating software purchase deals.

Rent

The Software as a service (SaaS) subscription model is a concept where you rent everything and access it through the cloud. The costs to use a Saas system is fairly consistent and you’ll pay for it monthly, quarterly or yearly to simply use the system. The service provider is responsible for maintaining and patching up the system, which is great for companies who do not have access to internal teams or resources to handle this.

With the current rapid pace of innovation in the financial services sector, agility will become the biggest source of competitive advantage. One of the biggest drawbacks of Saas systems is the perceived limited flexibility and customisation. Over the years, Saas vendors have become more flexible through the use of APIs. The openness in platforms enables vendors to create a more custom experience for their clients while leveraging off-the-shelf core functionality that can easily integrate into existing frameworks.

Security and the protection of sensitive data is another key issue raised when it comes to SaaS models. Moving your database over to the cloud can pose some security risks if the SaaS supplier does not take adequate precautions. It’s important to understand how they manage and mitigate risk with best practices such as multi-factor authentication, or even through the use of a hybrid cloud option to store sensitive information within your company’s control.

Technology to grow with you as you evolve

There’s no point in reinventing the wheel, particularly if software development falls outside of your core value proposition. When considering to lease technology, look for experts that develop cutting-edge solutions specifically for your industry and core issues. The SaaS space is incredibly competitive, with innovations and updates happening constantly. The openness of SaaS platforms makes it easier to change over to the latest solutions as new providers and innovations come to market, helping to drive a more responsive and future-forward organisation.

Pros and Cons of Renting:

Pros

- Faster time to market

- Easier integration with open SaaS APIs

- Lower capital expenditure (CAPEX)

- Typically easier to implement, depending on the scope of work

- Little to no maintenance costs

- Ease of accessibility through the cloud

- Scalability – the subscription model allows you to scale up or down based on your requirements

- Easier to keep up with continual innovation, as you can switch to a new SaaS provider with little to no cost

Cons

- May have limited flexibility and customisation options

- Connectivity issues due to cloud upgrades or internet outages

- Security issues and the protection of sensitive data

- Other providers may be using the same or similar product to you

Resources Needed for SaaS:

The SaaS model is by far the least resource-intensive option. The system is designed to be rolled out quickly and remotely, giving companies easy access to technology as and when they need it. Here is a generic list of the resources involved in a SaaS implementation:

Capital Expenses

- Internal Project Coordinator/Manager

Operating Expenses

- Monthly SaaS subscription costs

- Third-party integration costs (security etc.)

- Staff and user training

The SaaS model is becoming more popular across the spectrum, even amongst large players, who are looking to move away from long license periods, due to the cost structure and innovative benefits available. Small to medium businesses that have limited resources or access to internal IT capabilities will experience great benefits through a SaaS subscription system. Make sure that you choose a system that best suits your needs, and provides easy integration with other best-of-breed applications that your business uses frequently.

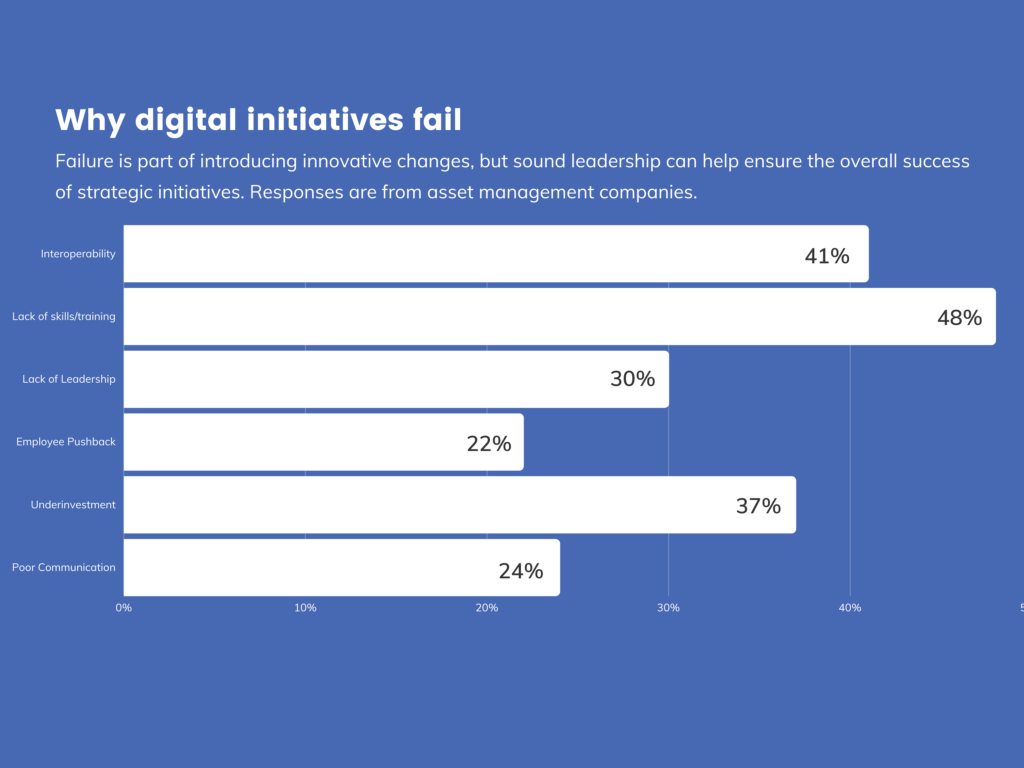

So, why do digital initiatives fail?

According to a report by BDO, the common roadblocks that asset management companies face once a digital project is underway includes lack of skills and training (48%), interoperability (41%) and underinvestment (37%). To combat this, companies need to focus on managing change during transformation projects by engaging and empowering all stakeholders, effectively plan for the functional changes within the operations team and ensure that the technical elements are in line to sustainably support the digital project in the long term.

Image Source: Source: 2020 Financial Services Digital Transformation Survey – The Future of Financial Services, BDO, 2020

Build, buy or rent fintech: which approach is best?

It’s important to understand the context of your business and the direction that you want to take your business in before you start making some decisions. Here’s a helpful framework to get to the heart of what kind of software you need:

- Identify the problem: Try to get a deeper understanding of what the problem is that your business is facing.

- Firstly: is this problem common in your industry? Jot down some other companies that face the same problem, and if possible, try to figure out how they are solving the problem or working towards solving it.

- Secondly: Are there solutions in the market that address this problem? Rate these on a scale of 1 – 10 in terms of how adequately they meet your needs, and jot down the pros and cons of each, as well as the costs.

2. Identify your available resources:

- What resources are available to see this project through to completion? This will help give you an idea of the internal funds and human resources that are available for the project, whether you choose to build, buy or rent fintech.

- Do you have the capacity to see the project through to completion, even if it goes over budget? This will help determine the level of financial risk you are willing to take when it comes to choosing the right solution for your business. For example, a SaaS solution will be much more financially predictable than a build solution.

- Do you have enough internal resources to manage the maintenance or upgrades once the project is complete? This is particularly relevant if you are considering a build or buy option, as these solutions require more ongoing maintenance than a SaaS solution.

3. Identify your timeline:

- If the problem is not solved soon, how badly will it affect my business?

- How quickly are the other companies in your industry finding solutions to this problem? Has this set the pace for change in your industry?

- How rapid is this change, and where do you want to position your company in this change? This will help determine whether your strategy is to be frontrunners, transforming firms or late movers.

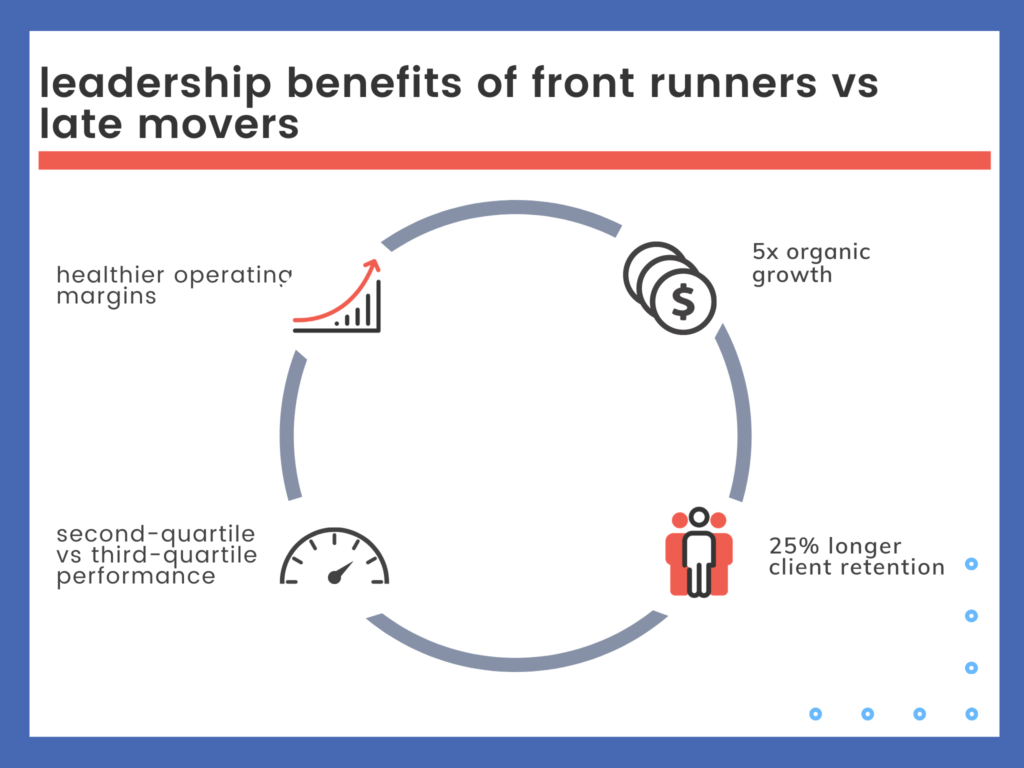

A recent report by CaseyQuirk indicates that frontrunners in the asset management space allocate the highest proportion of their budget (17%) to innovation, and experience tangible benefits such as 25% longer client retention and 5 times more organic growth. It’s becoming increasingly clear that technology adoption is central to financial service providers having a competitive advantage over new entrants and established providers.

Front runner investment management companies experience tangible benefits from employing technology ahead of competitors. Image source – Technology for the C-Suite: Driving Competitive Advantage in Investment Management, Casey Quirk, 2020

At the end of the day, your technology solution should advance you towards achieving your strategic and growth goals. There are various fintech approaches for wealth providers, and you should clearly identify what your unique value proposition is to determine whether building, buying or renting will work best for you. Companies that try to reinvent the wheel place a huge strain on their resources unnecessarily. Your technology should help foster an agile and adaptive business model that is primed to outperform competitors while helping you to remain relative in a rapidly changing marketplace.

Resources:

- Kalra, S, Marque, C, Renaud-Bezot, A, Ribelles, R, Whiteman, R, 2020, Breaching the Great Wall to Scale, McKinsey & Company, USA, https://www.mckinsey.com/business-functions/operations/our-insights/breaching-the-great-wall-to-scale?cid=other-soc-fce-mip-mck-oth—&sid=4337308450&linkId=107508496&fbclid=IwAR1Q7V7-W_Wyb5aH3g-4dgfoi6zOeIHKHD-ZkCvhTizsPMsjiPqoM7PKw8k

- Five Fifty: The Legacy Threat, 2020, McKinsey & Company, USA, https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/five-fifty-the-legacy-threat

- Success Rates Rise, Project Management Institute, 2017, USA, https://www.pmi.org/learning/thought-leadership/pulse/pulse-of-the-profession-2017

- 2020 Financial Services Digital Transformation Survey: The Future of Financial Services, BDO, 2020, USA, https://www.bdo.com/getmedia/b74a0e51-d361-4ceb-8688-13c5f46545f9/ADV_DTS_Middle-Market-Digital-Transformation-Survey_FS_web.pdf

- Cloherty, J, Levi, J, Phillips, B, Rosenfeld, C, White, J, 2020, Technology for the C-suite: Driving Competitive Advantage in Investment Management, Casey Quirk, https://investmentnews.co.nz/wp-content/uploads/5-Casey-Quirk-paper.pdf