When the first case of Covid-19 in December 2019 was reported, no one predicted the profound impact it would have on the world. From manufacturing, logistics, and tourism and financial services, every industry was forced to completely relook at their business processes and adapt to meet these new macroeconomic pressures.

The pandemic certainly accelerated digital adoption, with 61% of firms confirming that their technology budgets will increase over the next 3 years (WealthBriefing, 2021). Over the past few months, I’ve noticed that many financial service providers are starting to actively put in place concrete digital roadmaps, rather than the knee-jerk adoption we saw in the early stages of the pandemic.

Since the release of our report, Is your Business Ready 2020+, trends for the industry have pretty much stayed the same over the past year. However, there is a greater sense of urgency around these concepts as they hold even greater relevance as we look towards a post-pandemic future. Here are the top four trends that I think will shape the industry over the next year, and will be key in driving differentiation amongst financial service providers:

1:Rethinking the customer journey

The pandemic has given rise to an amazing opportunity to completely redefine and map new customer journeys. Simply transferring your current processes over to a digital platform is not going to be sustainable in the long term. Wealth providers need to shift their mindsets to adjusting to the customer and meeting them where they need, rather than where it is convenient for the provider.

With the arrival of 5G, and the increasing reach of artificial intelligence (AI) and machine learning, companies need to align their customer-facing strategies to satisfy the ever-changing needs of investors. The ability to create meaningful virtual experiences that offer tangible and personalised value to investors will separate the leaders from the laggards going forward.

When looking at onboarding, a crucial first step in the customer journey, Ernst & Young expects that by 2022, 46% of all wealth activities will happen on mobile phones, with website access dropping to 20%. Recent research has shown that wealth providers are clearly planning for mobile-first interactions with 70% indicating that they have already implemented a mobile app, and a further 22% planning to implement it in the imminent future (WealthBriefing, 2021).

Instead of merely replicating your onboarding process and questions into a digital format, think of what an engaging mobile-first onboarding experience will look like. Each customer segment will have its own unique journey, and it’s important to map out and create a tailored experience to effectively attract and retain these segments.

For example, women typically spend more time researching their investment choices and respond well to easily accessible information. In the onboarding process, AI-driven chatbots could provide more information during the sign-up process and help drive a more informed customer journey for this segment.

The below graph clearly shows the adoption rate of client-facing enhancements and the acceleration of these over the past two years. What’s interesting to note is that the top client-facing enhancements on providers’ priority lists include robo-advice, customised reporting and instant messaging. With only 37% of investors giving their wealth providers top marks for digital experiences, companies would be wise to leverage these client-facing tools to deliver intuitive and tailored investment experiences to better serve customers.

[Source: Tech and Ops Trends in Wealth Management, 2021, Wealthbriefing, Weatherill and SS&C Advent.]

[Source: Tech and Ops Trends in Wealth Management, 2021, Wealthbriefing, Weatherill and SS&C Advent.]

Providers also need to rethink how their clients access and process market updates and information. Gone are the days of lengthy, static reports that are difficult to read and understand. Automated prompts, conversational chatbots and real-time market alerts with supporting information can be displayed in highly engaging and graphical formats through client portals and mobile apps. With 80% of investors wanting more dynamic content integrated into their investment experiences, it’s clear that there is a demand for educational tools and greater

2: Data, data and more data

Data and analytics are set to shake up the traditional wealth management industry in a big way. Digital platforms, such as Robinhood and Betterment, build their platforms around harnessing the power of customer data. As a result, they have created intelligent client-centric business models that respond to changing customer demands and provide a personalised experience for each investor.

Detailed client data, and the effective management thereof, will become a major source of competitive advantage in the future. Capturing and safely storing this data is the essential building block to capitalise on cutting edge technology, applications and platforms – both now and in the future.

While most companies tend to have a simple analytics system in place, whether it’s done manually through spreadsheets or a Customer Management System (CMS), we’re going to see a massive shift in companies’ fast-tracking their data strategies. According to Deloitte, they predict that industry players are starting to leverage descriptive and predictive analytics that process internal, external, structured and unstructured data to create more complete client profiles.

What will this look like for wealth providers? This type of analytics will allow providers to develop client segments that go beyond the traditional boundaries of AUM, age and gender. It will enable providers to develop context-rich customer profiles and service them in a deeper and more meaningful way that matches their sentiments, attitudes and life stage perfectly.

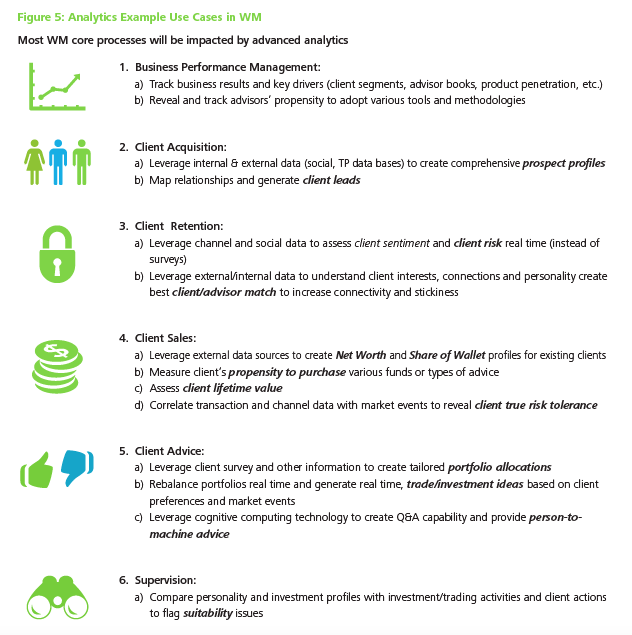

Deloitte states that companies will be in a better position to assess current and potential “customers’ propensity to purchase certain products and services, their lifetime value, investment style and risk tolerance.” Below is a powerful list of areas where analytics will play a crucial role for wealth providers in the future:

[Source: Vincent, G. Cunniff, S. Goldstein, J. (2021) 10 Disruptive Trends in Wealth Management, Deloitte.]

[Source: Vincent, G. Cunniff, S. Goldstein, J. (2021) 10 Disruptive Trends in Wealth Management, Deloitte.]

3: Robo advice to support human advice

With a significant 40% year-on-year growth reported in the US, the confidence and willingness to make use of robo-advice will only improve in years to come. While many investors are sceptical of using robo-advisors, providers can certainly see the appeal of this technology due to its resource-saving capabilities.

In previous years, advisors felt threatened by this new technology as it sparked fears of massive job losses. However, we are starting to see more and more companies explore the multiple uses of robo-advice technology. According to Wealthbriefing (2021), just over a third of wealth providers indicated that their companies will be implementing robo-advice and automation tools.

For firms wanting to target the retail market, robo-advice offers a cost-effective way to ensure that entry-level investors are getting access to quality advice to help kick-start their investment journey. When targeting a larger market, robo-advice can certainly help bridge any resource gaps firms may have in their advice departments.

It’s also an effective tool to help improve human advisor productivity, and perhaps reposition these employees to deliver more tangible value to customers in different ways. With the intense scrutiny that fees face at the moment, providers can maximise their competitive advantage by providing a more engaging and value-driven investment experience to retain clients in the long run.

Robo-advice can also take the provider beyond the traditional operating hours of 9 am to 5 pm. It makes it easy for customers to access advice 24/7, and complete the advice process in a fraction of the time it takes to walk through the questionnaire with an advisor. Automated prompts, with further information and data, can be set up to help guide investors through the digital questionnaire – similar to how a human advisor would talk through certain points.

4: Choosing digital differentiation over digital transformation

The increased urgency and fast-paced nature of the current market will inevitably push providers to implement ways to set themselves apart from competitors. Cumbersome and lengthy digital transformation plans will be pushed aside for more dynamic and responsive digital strategies.

With time pressures, we’ll start to see shorter RFP processes and fewer proof of concepts as providers become more comfortable with utilising specialist third party fintech vendors. Companies need to work towards a clear goal, from the top-down and build a culture that supports quick, strategic decision-making.

While there are certainly non-negotiables when it comes to digital functionality (such as digital onboarding, client portals, and mobile apps), your digital transformation plans need to be more than a box-ticking exercise. Within these non-negotiables, providers must look for ways to improve the overall experience and further streamline the process to drive a competitive advantage.

Sources:

https://www.wealthadviser.co/2020/05/18/285696/us-robo-advisory-industry-hit-usd1tn-value-year

Tech and Ops Trends in Wealth Management, 2021, Wealthbriefing, Weatherill and SS&C Advent.

Vincent, G. Cunniff, S. Goldstein, J. (2021) 10 Disruptive Trends in Wealth Management, Deloitte.